sylviastyles4

About sylviastyles4

Maximizing Your Wealth: The Best Gold and Silver IRA Options Obtainable Right now

In in the present day’s unpredictable financial landscape, many buyers are turning to various assets like gold and silver to safeguard their wealth. Gold and Silver Individual Retirement Accounts (IRAs) have emerged as standard decisions for those looking to diversify their retirement portfolios. In this text, we are going to discover the best gold and silver IRA choices currently out there, highlighting their options, advantages, and how they’ll assist you to secure your financial future.

Understanding Gold and Silver IRAs

A Gold or Silver IRA is a self-directed particular person retirement account that enables buyers to hold physical treasured metals as a part of their retirement financial savings. In contrast to conventional IRAs, which sometimes hold stocks, bonds, or mutual funds, a Gold or Silver IRA offers a hedge against inflation and foreign money devaluation. The intrinsic value of treasured metals often will increase during economic downturns, making them a reliable retailer of value.

The Importance of Diversification

Diversifying your retirement portfolio is crucial for mitigating risk. By incorporating gold and silver into your IRA, you may reduce your publicity to unstable markets and enhance your potential for long-time period progress. If you have any sort of inquiries relating to where and ways to use Gold-Ira.Info, you can call us at the web-site. Precious metals have traditionally maintained their value over time, making them a pretty possibility for investors looking for stability.

Best Gold and Silver IRA Suppliers

- Birch Gold Group

Birch Gold Group has established itself as a leader within the gold and silver IRA industry. With a commitment to educating shoppers about precious metals, Birch Gold gives a variety of funding options. They supply personalized service, helping buyers choose the precise metals for their portfolios. Birch Gold additionally boasts a clear charge structure, guaranteeing that shoppers perceive all prices associated with their investments.

- Noble Gold Investments

Noble Gold is understood for its exceptional customer support and consumer-pleasant platform. They provide quite a lot of gold and silver products, including coins and bullion, making it easy for traders to construct a diverse portfolio. Noble Gold also supplies academic sources, serving to clients make knowledgeable choices about their investments. Their simple pricing and no hidden charges make them a high choice for those new to precious metals investing.

- Regal Property

Regal Property stands out for its innovative approach to gold and silver IRAs. They provide a singular option to invest in cryptocurrency alongside treasured metals, interesting to tech-savvy traders. Regal Belongings has a powerful popularity for its fast and secure transactions, in addition to its dedication to customer satisfaction. Their intensive collection of gold and silver products, mixed with competitive pricing, makes them a formidable participant within the business.

- American Hartford Gold

American Hartford Gold is devoted to offering a seamless experience for buyers wanting so as to add valuable metals to their IRAs. They offer a large variety of gold and silver products, together with uncommon coins and bullion. American Hartford Gold is known for its exceptional academic resources, helping clients understand the benefits of investing in valuable metals. Their clear fee construction and commitment to customer support make them a reliable alternative for buyers.

- Goldco

Goldco is a well-established company that makes a speciality of valuable metals IRAs. They provide a comprehensive vary of gold and silver products and deal with helping clients protect their wealth. Goldco provides personalised funding recommendation and a wealth of educational assets, empowering shoppers to make informed choices. Their dedication to transparency and customer support has earned them a loyal following amongst buyers.

Key Options to think about

When choosing a gold and silver IRA provider, there are several key options to think about:

- Status and Trustworthiness: Look for corporations with a robust monitor file and positive customer opinions. Verify their rankings with organizations like the better Business Bureau (BBB) to make sure they’re respected.

- Fees and Costs: Understand the price structure related to the IRA. Search for suppliers with clear pricing and no hidden charges. Common fees embrace setup fees, storage charges, and transaction charges.

- Investment Options: Evaluate the vary of gold and silver merchandise offered by the provider. A various selection allows for better customization of your portfolio.

- Customer service: Choose a provider that offers excellent buyer assist. A educated and responsive staff can enable you navigate the complexities of investing in precious metals.

- Educational Sources: Search for firms that present academic materials that can assist you perceive the benefits and dangers of investing in gold and silver. This will empower you to make knowledgeable decisions about your investments.

The Means of Establishing a Gold or Silver IRA

Establishing a Gold or Silver IRA is a simple process:

- Choose a Supplier: Research and select a good gold and silver IRA provider that meets your needs.

- Open an Account: Complete the required paperwork to open your self-directed IRA account. This typically includes offering private data and deciding on a custodian.

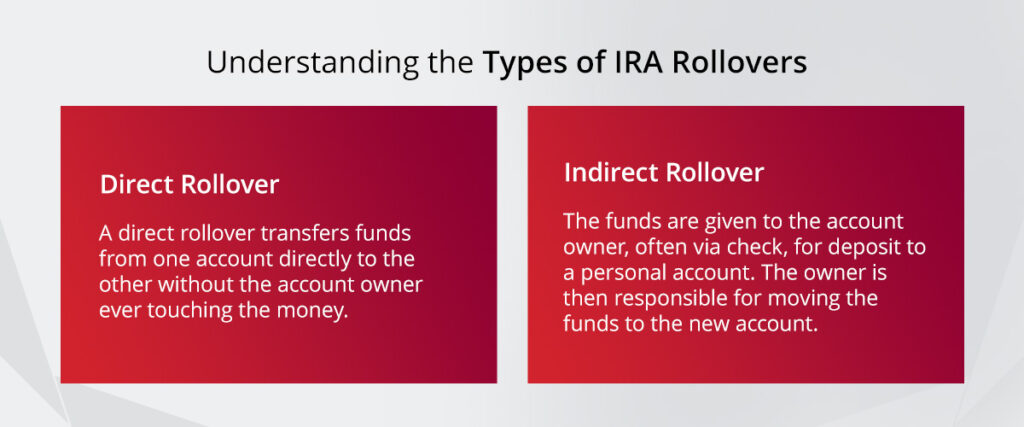

- Fund Your Account: You may fund your IRA by a direct transfer from an current retirement account, a rollover, or by making a money contribution.

- Select Your Valuable Metals: Work along with your supplier to decide on the precise gold and silver products you want to incorporate in your IRA.

- Storage: Your treasured metals should be stored in an accredited depository. Your supplier will assist arrange safe storage to your investments.

- Monitor Your Investments: Regularly evaluation your portfolio and make adjustments as wanted to align along with your monetary objectives.

Conclusion

Investing in a Gold or Silver IRA can be a strategic move to diversify your retirement portfolio and protect your wealth against economic uncertainty. With a variety of reputable suppliers available, traders have the chance to choose one of the best possibility that aligns with their financial goals. By understanding the options, charges, and processes involved, you possibly can confidently navigate the world of precious metals investing and secure your financial future. As always, consider consulting with a monetary advisor to make sure that a Gold or Silver IRA is the appropriate match for your retirement strategy.

No listing found.